Carpe Diem Plan will enable you to organise your End of Life now and make plans for the future.

‘If you became unable to manage your affairs would your next of kin know how to locate your vital information? Your life insurance? Your will? Your health care wishes? How to care for your pets? Your Bitcoin fortune?’

Recently a number of friends and acquaintances died and some had a copy of the Plan, but put off completing it. It is important to think about the consequences of that happening to you NOW.

Susi Richardson January 2025

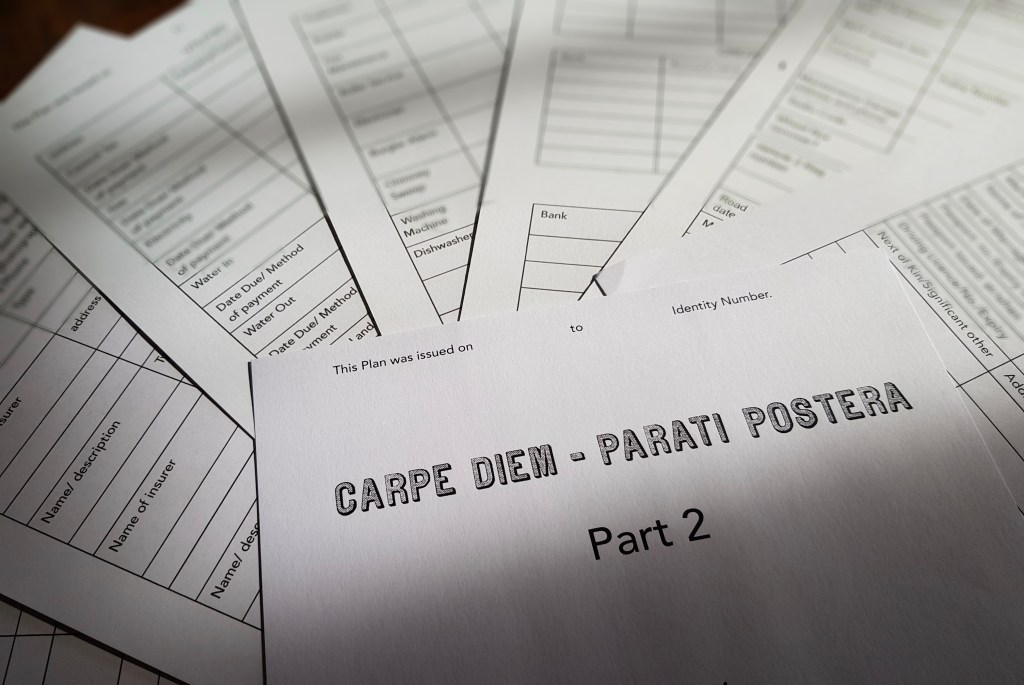

60 pages of tables and information

The Carpe Diem Plan has been designed as an off line, ‘All in One Place’ paper document, but with the understanding that security of information becomes an individual’s responsibility. This Plan should not be taken as giving legal, financial or medical advice.

The Carpe Diem Plan

This document is a comprehensive personal planning and record-keeping template designed to help you organise and safeguard your personal, financial, legal, and digital information. Here’s a brief summary of its structure and purpose:

Overall Purpose:

It serves as a detailed checklist and repository for critical information—making it easier to manage your affairs, prevent identity theft, and ensure that your wishes are known and can be acted upon when needed.

Part 1 – “Seize the Day”:

• Personal Details & Property: Records essential personal information, property details, and insurance policies.

• Utilities & Services: Lists details for utilities, tradespeople, vehicles, bank accounts, and credit/debit cards.

• Health & Contacts: Includes health information and a contact list for friends and relatives.

Part 2 – “Preparing for the Next”:

• Future Planning: Focuses on preparing for unexpected events by documenting next-of-kin details, drafting a will, and establishing a lasting power of attorney.

• Legal & Medical Considerations: Provides space to record legal documents, details for executors, and personal wishes related to medical care.

Part 3 – “When I am gone”:

• Post-Death Arrangements: Guides on what to do following a death, including registering the death, notifying institutions, and managing funeral arrangements.

• Financial and Estate Management: Contains sections for professional advisers, pension details, personal and joint accounts, and inventories to aid executors and beneficiaries.

Part 4 – “Critical Information”:

- Sensitive Data & Digital Accounts: Dedicated to storing highly sensitive data such as passwords, digital account details, credit/debit card information, and online media account instructions—ensuring this information is secure yet accessible when needed.

- Overall, this document is designed to keep your critical information in one place, making it easier for you or your trusted contacts to manage your affairs both in everyday life and during times of crisis or after you die.

THE SECURITY OF THE PLAN IS YOUR RESPONSIBILITY AND WE TAKE NO RESPONSIBILITY FOR ITS SAFETY ON LINE. THE PLAN IS DESIGNED TO BE COMPLETED OFF LINE.